When it comes to achieving our financial dreams, having a clear action plan is critical. Enter goal setting, which can help turn vague ambitions into concrete objectives you can measure and accomplish.

The simple act of setting goals can be the catalyst for real behavior change. In fact, research from the University of Manchester suggests that goal setting is a potential key ingredient for success.

Setting goals is the first step — the next is following through. Here are four ways to bring your financial dreams to life.

1. Determine your goals.

It’s hard to make progress if you don’t know where you’re going. The first step to achieving your financial goals is to determine what they are. If you aren’t sure where to start, the following questions can help bring things into focus:

- What are your current stress points?

Sometimes it’s helpful to think in terms of what’s not working. Take a moment to consider parts of your financial health that are causing you stress. Maybe a high debt load has you living paycheck to paycheck, or a lack of savings is keeping you up at night. Identifying these pain points is an opportunity to spin them into achievable financial goals. - What do you really want to accomplish?

Tuning into your desires can help you shape financial goals that you’re emotionally connected to. That’s no small thing as it could provide the motivation you need to cross the finish line. For example, you may have an easier time staying the course if you’re saving to buy a home for your family or to pay for a portion of your kids’ college education. Simply put, your “why” is tied to your emotions. When you face challenges, remind yourself why you set the goal in the first place. Visualizing your progress along the way can also help stoke motivation, according to research from Virginia Tech. - What does financial freedom look like to you?

This simple question can tap a wellspring of financial desires. The more honest you are in your response, the easier it will be to create action-backed financial goals. When you think about financial freedom, what images and feelings come to mind? For some, it may mean having a solid emergency fund. Others may equate being debt-free with financial peace of mind.

2. Make your goals SMART.

SMART goals are objectives that are linked to the attributes below. Structuring your financial goals in this way can reduce ambiguity so you can begin moving in the right direction.

Specific

What is your specific goal? If, for example, you want to build up your savings account, put a dollar amount to your goal.

Measurable

How will you measure your progress and hold yourself accountable?

Achievable

Do you have the necessary resources to achieve your goal? In other words, is it a realistic goal? You don’t have to abandon it if it feels too lofty. Instead, consider tweaking your expectations to set yourself up for success. Baby steps can add up over time.

Relevant

Why is this goal important to you? Again, try to connect it to your emotions

Time-bound

When would you like to accomplish this goal?

3. Break big goals into smaller action items.

When you feel good about the financial goals you’ve set for yourself, it’s time to make a savings plan. Refer back to your timeline and savings target for each one. Let’s say you want to pay off $10,000 of debt over the next 18 months. You can now back into that number to create short-term goals. To achieve your big-picture objective, you’ll need to save $555 per month. How do you plan on doing that? If you get paid twice monthly, you can divide this number in half and set up automatic transfers to your savings account for each paycheck.

No matter your goal, the idea is to treat these smaller action items like any other bill on your budget. Just be sure to track your progress along the way to gauge how you’re doing. Are you regularly falling short of your short-term goals? If so, understanding why can help you get back on track. On the flip side, celebrating the wins can help you maintain motivation. Whenever you cross a big milestone, consider treating yourself to a budget-friendly reward.

4. Seek out support.

When working toward your financial goals, know that you don’t have to go it alone. Seeking out the support of others can actually improve your odds of success. According to research from Ohio State University, sharing your goals with people you look up to can reinforce your dedication and willingness to persevere.

Another strategy is connecting with someone who’s also working toward financial goals. In this way, you can share your progress, challenges and successes. It’s akin to having a workout buddy who pushes you to stick to your fitness routine. Having someone in your corner to provide emotional support and encouragement can make all the difference.

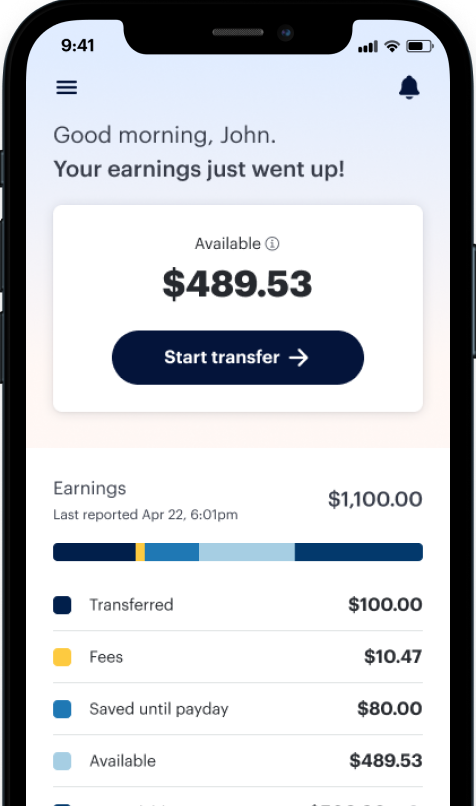

Saving for financial goals usually takes time. What matters most is having a clear idea of what you want your financial life to look like. From there, you can create an action plan that supports your vision. DailyPay is one resource that can help you on your journey to financial wellness