A payday loan is usually a high-cost, short-term loan that typically has to be repaid by the borrower’s next payday. “High-cost” is the operative word here. According to the Federal Trade Commission (FTC), three-digit interest rates are not uncommon. Laws vary from state to state on the allowable range of amounts for such loans, but $500 is a common loan limit.

While payday loans can provide quick cash in a pinch, they aren’t without risk. Falling behind on this type of loan could leave you stuck in a costly debt cycle that has a lasting effect on your financial health. Here’s a more in-depth look at how payday loans work.

How do payday loans work?

Payday loans usually come due two to four weeks after the loan is made, according to the Consumer Financial Protection Bureau (CFPB). Some states do allow payday lenders to extend the due date, though the borrower will likely still be on the hook for fees. Installment payments over a longer period of time may also be an option in some cases, but not always.

To guarantee repayment of a payday loan, lenders usually require borrowers to give the lender a post-dated check for the full balance of the loan, plus any applicable fees. If the borrower does not repay the loan by the due date, the lender might cash the check or withdraw funds from the borrower’s bank account electronically. Again, state laws vary. Some states allow payday lending in compliance with certain regulations, while others prohibit it altogether.

Why are payday loans dangerous?

Payday loans are notoriously expensive. Let’s say you take out a payday loan that charges a $15 fee for every $100 borrowed. The CFPB reports that a typical two-week payday loan structured in this way has an annual percentage rate (APR) that’s close to 400%. Even if you pay your loan on time, doing so can be expensive due to the high interest rate. The average payday loan is $375 and charges an average of $520 in fees, according to Bankrate.

As mentioned earlier, it isn’t uncommon for payday lenders to cash a post-dated check or to electronically withdraw funds from your bank account if the loan isn’t repaid as promised. That could have a domino effect that causes you to fall behind on your other bills—and you might need to take out another payday loan to get caught up. Payday lending can create a cycle where borrowers are perpetually indebted while also paying high interest rates and fees. It can be a financially dangerous situation, especially for folks living paycheck to paycheck. According to data provided by Credit Summit, only 14% of borrowers are able to pay back their payday loans.

According to the FTC, some payday lending operations have used illegal or deceptive conduct to prey on financially distressed consumers. This has included the use of misleading advertising and billing practices, as well as abusive debt collection tactics.

Alternatives to payday loans

Payday loans may sound like a good idea in the moment, but consumers would be wise to proceed with caution. The following payday loan alternatives might be worth exploring:

- Personal installment loan: With this type of loan, the lender transmits the entire value of the loan as a lump-sum payment. The borrower is generally required to repay it in fixed amounts over a specified time period. Most lenders will consider the borrower’s credit, income, debts and other personal financial details when making a lending decision. Personal installment loans may charge a variety of fees. The average APR ranges from 9.30% to 22.16%, according to ValuePenguin.

- Borrowing money from a friend or family member: In some cases, a friend or loved one may be able to loan you money if you’re in a financial bind. If you go this route, you may consider writing up a contract that outlines your total loan amount and repayment schedule. This might make the other person feel more at ease. Just keep in mind that failing to repay the loan could damage the relationship.

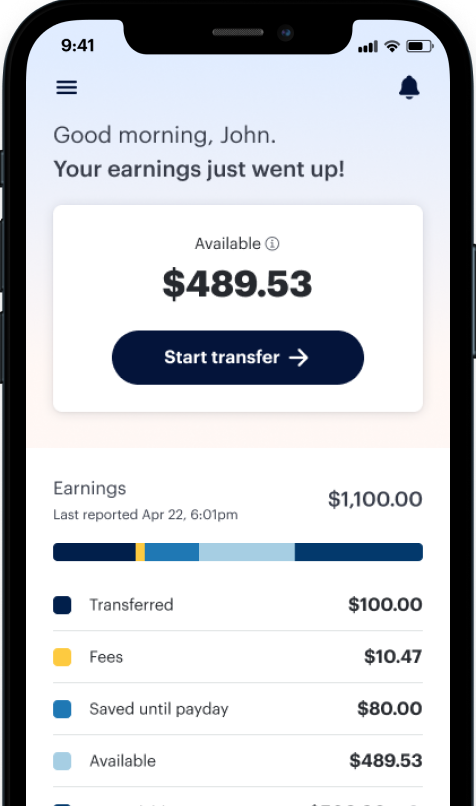

- See if your employer offers On-Demand Pay: This employee benefit allows workers to choose when they get paid. Earnings accumulate gradually with each day of work. You can then transfer funds and access your money as you need it, usually at a nominal fee. Any leftover funds will come through with your next regular paycheck. Not all employers offer On-Demand Pay, but it could help some folks cover an unexpected bill that pops up before payday.

Far and away, one of the most prudent ways to avoid payday loans is to build up your emergency fund. Having a pool of money in your savings account can provide peace of mind. If you’re caught off-guard by a financial surprise, this cash reserve could help see you through. You’re essentially borrowing money from yourself, interest-free. Setting aside three to six months’ worth of expenses is a recommended benchmark. If you’re starting from scratch, try automatically transferring some portion of every paycheck into your savings account—then watch it grow over time.

All information herein is for educational purposes only and should not be relied upon for any other use. The information herein does not constitute the rendering of financial advice or other professional advice by DailyPay. No fiduciary obligation or duty exists, or is created, between you and DailyPay. DailyPay does not warrant the completeness or accuracy of any information provided to you.