Debt isn’t necessarily a bad thing. Your student loans, for instance, may have funded your education and allowed you to pursue your career. If you’re able to keep up with your payments, that may feel like a worthwhile trade. It’s overwhelming debt that can be crippling — think high-interest accounts you an’t seem to conquer.

The average U.S. family has $6,270 in credit card debt alone, according to the Federal Reserve. Not surprisingly, research from the University of Nottingham suggests a link between “problem debt” and psychological health.

Now for a motivation boost. Taking control of your debt can feel more doable when you’re empowered with tried-and-true strategies. Let’s dig into a few simple approaches to tackling your debt once and for all.

First, let’s talk interest rates

Before we get into the details, it’s important to first understand how interest rates work. This is the amount lenders and creditors charge to borrow money. Credit cards, which are known for super high rates, can be a killer. At the time of this writing, the average APR lands at 16.3%.

You can avoid interest altogether by paying your bill in full each month. If not, the interest you’ll pay is based on your APR and balance. Most credit card issuers will also compound interest. This means your accrued interest is added to your outstanding balance so that you’re essentially paying interest on interest. It’s easy to see how so many people get swallowed up in a debt cycle.

Different ways to pay off debt

Making minimum payments alone isn’t usually enough to move the needle in a big way. Instead, it’s about targeting one account at a time to hit harder than all the others. To be clear, you’ll still make minimum payments on your other accounts — you’re just accelerating your efforts on one balance. Once that’s paid off, you take the money you were paying there and roll it into the next account.

So which balances do you prioritize first? Below are two different approaches:

Snowball method

The snowball method puts your lowest balance first. Begin by listing out all of your outstanding debt, paying attention to your account balances and interest rates. Continue making your minimum payments on all of your accounts — except the one with the smallest balance. You’ll want to put more muscle behind these payments. Doing so should help you pay down the balance faster, assuming you aren’t accumulating new debt. Once your balance gets to zero, move onto the next smallest balance.

While you may save more money in the long run paying off higher-interest accounts first, research suggests you may be more likely to succeed using the debt snowball method. Seeing your balances drop off one after the other can be highly motivating.

Avalanche method

The avalanche approach uses the same idea as the debt snowball, except that you’re prioritizing the account with the highest interest rate. That means the balance itself is irrelevant. As such, it may take some time to see a big balance disappear entirely — but you’ll be keeping more cash in your pocket over the long term. Research from James Madison University also suggests that the avalanche approach is actually more efficient, helping you cross the debt-free finish line faster than the snowball method.

Other helpful tips

At the end of the day, the best debt payoff method is whichever one feels right for you. Some people love celebrating the mini-wins that go hand in hand with the snowball method, while others care more about saving the most money. Either way, the extra tips below can help you make progress even faster:

- Every time you come into a wave of extra income, put it toward your outstanding balances. This includes tax refunds, work bonuses and so on. It can help make bigger dents in your accounts.

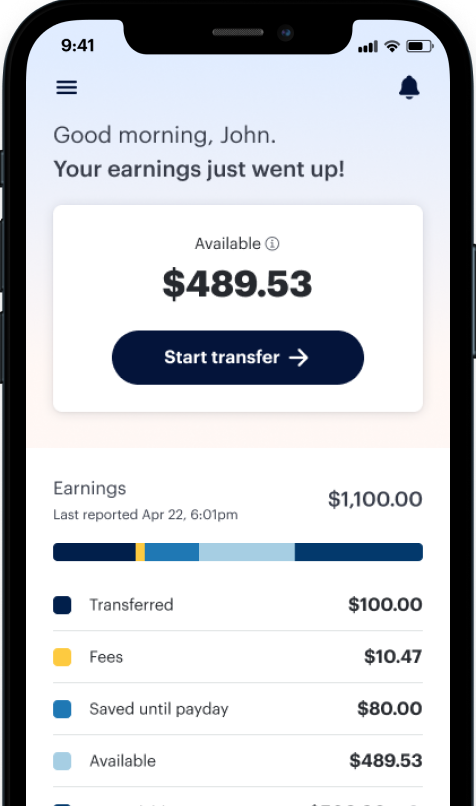

- Consider picking up a side gig or part-time job to up your income.

- Whenever you get a raise, put the influx of income toward your debt while maintaining your same lifestyle.

Staying debt-free

While you’re on the journey to paying off your debt, understanding what caused it can help prevent it from happening again. Maybe a medical emergency or unexpected job loss rocked your income. Perhaps chronic overspending is the culprit. Regardless of why you’re in debt, getting down on yourself will only make things worse. Instead, focus on building a stronger financial foundation so you can break the debt cycle.

- Fine-tune your budget. If your monthly spending outweighs your income, focus on expenses you can trim or eliminate. An approach like the 50/30/20 budget can help you organize your income in a way that makes room for essential bills, financial goals, and fun money. Budgeting is also one of the best ways to prioritize your debt payments.

- Build your emergency fund. Having a reserve of cash sitting in your savings account can come to the rescue the next time you’re faced with a financial emergency. The big goal is to set aside three to six months’ worth of expenses, but start where you are. Even having a $1,000 micro-emergency fund can be a great safety net that prevents you from accumulating new debt.

- What is an Emergency Fund?

When it comes to paying off debt, you have a few different options on hand. What matters most is sticking with it. Every balance you eliminate frees up more money in your monthly budget that you can funnel toward other financial goals. You’ll also be increasing your credit score along the way, which is another big win. In the meantime, DailyPay can help you get the most out of your income.