Managing your money can feel overwhelming sometimes. A recent MoneyGeek survey found that 89% of respondents were stressed out by their finances—and one of the top stressors was managing credit card debt. If you’ve got some debt to your name, you aren’t alone. The Federal Reserve reports that the typical U.S. family carries over $6,200 in credit card balances.

Paying down credit card debt is a great financial goal because it frees up more money for things that really matter to you, whether that’s saving for a house, building your emergency fund or taking a family vacation. The truth is that credit card balances can eat away at your income, thanks to their sky-high interest rates. The average APR is a whopping 16.4%.

A balance transfer credit card is one way to pay off debt faster—while saving money in the process. Here’s how it works.

What is a balance transfer credit card?

When a monthly credit card payment comes due, you normally can’t pay it with another credit card. Instead, you’ll have to rely on your checking account to cover it. A balance transfer card is exactly what it sounds like. Once approved, you can use it to pay down other credit cards. From there, more of your debt will be in one place with a single monthly payment.

Balance transfer cards provide more than just convenience. Many offer 0% introductory periods that can last up to 21 months. Your transferred balance will not accrue interest during this time. That allows you to hit that balance hard and make a real dent in your debt load. The idea is to pay off your entire balance before that 0% promotional period ends. If you’re able to pull it off, you’ll end up saving money and getting debt-free faster.

Drawbacks of using a balance transfer credit card

Paying down debt with a balance transfer credit card certainly has its perks, but there are some disadvantages worth noting. Transfer fees are pretty standard. It isn’t uncommon to be charged 3% to 5% of the transferred balance, according to NerdWallet. This amount is usually factored into the transfer itself, which means you may not be able to roll over as much debt as you’d hoped. But if you’re up against high-interest credit card debt, a small transfer fee may be worth it in the end.

Another important thing to consider is that balance transfer cards really only make sense if you can pay off the entire balance within that 0% promotional period. The card’s regular interest rate will kick in after that window closes, which means you’ll be charged interest if there’s an outstanding balance. Most balance transfer cards have APRs ranging from 12.99% to 24.99%, according to Bankrate. That could trigger a huge fee if you fail to pay off your balance in time.

Your credit score will also come into play, as the best terms on balance transfer cards generally go to borrowers with strong credit. You’ll likely need a FICO Score of 670 or higher to qualify, according to Experian. Taking steps to improve your credit beforehand can help boost your odds of getting approved for a balance transfer card.

Are balance transfer cards worth it?

It really all depends on your debt load and ability to pay off your balance transfer within the 0% promotional period. Let’s pretend you have $4,000 in credit card debt. The APR is 17% and the minimum monthly payment is $150. According to Credit Karma’s debt repayment calculator, it’ll take you 31 months to get debt-free. You’ll also pay about $976 in interest.

Now let’s say you move your debt over to a balance transfer card that has 0% interest for 24 months. We’ll also assume there’s a 3% transfer fee, which would amount to $120. With this option, you’d get out of debt seven months earlier and pay no interest. What’s more, your monthly payment would only go up by $22.

How to find a balance transfer credit card

If you decide that a balance transfer card is right for you, it’s relatively easy to shop around online for the best offer. Just be sure not to apply for a bunch of cards all at once. Each application will trigger a hard inquiry on your credit report, which can temporarily drag down your credit score. Instead, a quick Google search of “best balance transfer cards” will lead you to lots of online platforms that provide side-by-side comparisons without affecting your credit. This can help you find the best deal before applying.

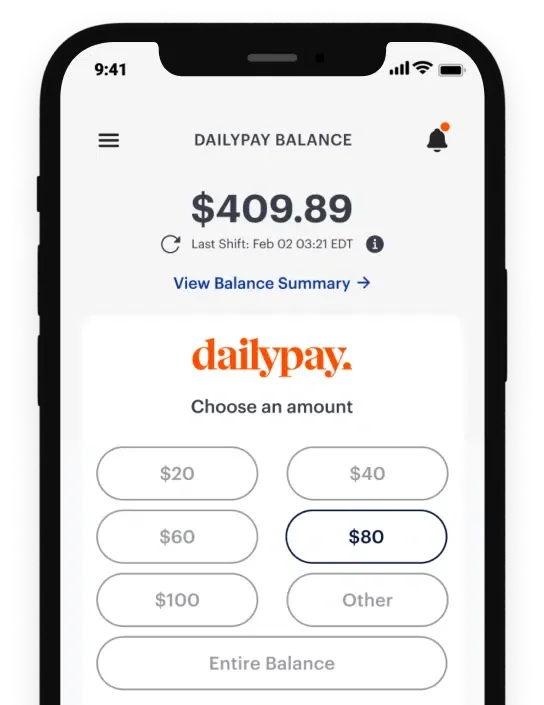

In the end, a balance transfer credit card can be a great tool for paying down debt faster—and saving you money over the long term. It’s another financial resource at your disposal. DailyPay is right there alongside it, providing access to your earned pay whenever you see fit.