Unemployment benefits sort of act as a safety net. If you lose your job through no fault of your own, you may be eligible for weekly checks to help supplement your income. These benefits are provided through state-run programs to help ease the financial burden.

The Covid-19 pandemic threw 21.1 million people out of the workforce in April 2020; a record high that pushed the unemployment rate to 14.7%. In response, the federal government stepped in and supplied an additional $600 per week to those who qualified. That number eventually dropped to $300, but that’s still $1,200 in monthly income that many relied on to help pay rent and other basic expenses. If you were on the receiving end of these benefits, you’ve probably learned that this extra money stopped coming in early September (though some states cut off this federal perk even earlier out of fear that it was deterring people from looking for work).

Either way, the September deadline affected more than 3 million recipients, according to estimates from The Century Foundation. Here’s a quick guide for rebounding after losing your unemployment benefits.

How do unemployment benefits work?

Unemployment benefits can vary greatly from state to state. According to the U.S. Department of Labor, you’ll likely qualify if you:

- Are unemployed due to lack of available work

- Worked a specific amount of time and met certain wage requirements

- Meet any additional requirements your state may have in place

- Are actively looking for a new job

The data we mentioned earlier from The Century Foundation reports that the average amount paid out by states is $334 per week. Every state also has its own criteria when it comes to how long they’ll dole out unemployment benefits. Most do so for 26 weeks, but this isn’t always the case. Your state may also cap your benefit once it hits a certain amount.

To be clear, these state-provided unemployment benefits aren’t ending — it’s that extra $300 per week from the federal government that dried up.

What to do if you lost your extra unemployment benefits

Losing access to a few hundred dollars every week can feel like a shock to the system when you’re unemployed. Read on for some helpful ways to stabilize your finances.

If you’re still unemployed

Trim your expenses.

When money is tight, reducing your expenses as much as possible will help your dollars go further. Revisit your budget to better understand your spending habits. Are there any bills you can live without? This may require some temporary sacrifices, such as cutting cable or doing away with creature comforts like subscription services or memberships.

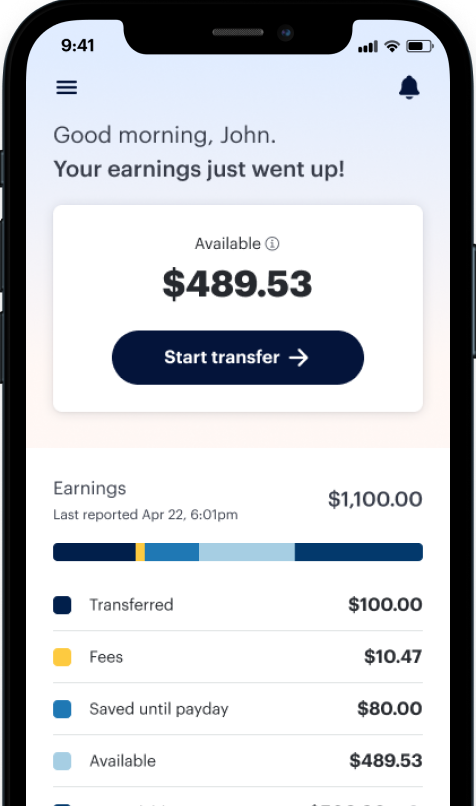

The goal is to bring down your monthly spending and stretch your unemployment checks. Clarify how much you receive every week and how long your benefits are set to last, then build your budget from there. (Just an FYI, you may have to pay taxes on your unemployment benefits.)

Put some muscle behind your job search.

To qualify for unemployment benefits, you’ll likely have to prove that you’re making a good faith effort to find work. Your benefits will end when you land a new gig, but you’ll hopefully be getting a steady paycheck going forward. Consider the following tips for elevating your job search:

- Step up your networking. Now is the time to connect with anyone you’ve worked with in the past, or folks who currently work in the industry you’re hoping to break into. Don’t be afraid to attend networking events or schedule informational interviews with people who could help you in your job hunt.

- Update your LinkedIn profile. Treat your LinkedIn profile like a digital resume. Be sure to include any work and life experience that could make you an attractive job candidate. You can also include important keywords in your profile that are relevant to your industry. This will help make you more visible to recruiters who are looking to fill openings.

- Consider freelancing. If possible, see if you can get your foot in the door as a freelancer. If you do great work and impress your managers, there’s a good chance they’ll think of you when a permanent position opens up.

If you’ve since found work

If you’ve secured a new job and are saying so long to your unemployment benefits, good on you! Take some time now to get your finances back on track if they went off course a bit. Here are a few ways to financially rebuild after a bout of unemployment:

- Assess your budget to make sure your new paychecks cover all your bills. If not, you may need to make some tweaks.

- Strategize a game plan for paying off your debts

- Revisit your financial goals and make a new plan for moving forward

All information herein is for educational purposes only and should not be relied upon for any other use. The information herein does not constitute the rendering of tax advice, financial advice or other professional advice by DailyPay.