Savings isn’t just about setting aside money; it’s about securing a financial future, achieving goals, and enjoying peace of mind along the way.

It’s a psychological approach to personal finance that prioritizes long-term financial wellness over short-term gratification.

This mindset requires preparation, discipline, purpose, and balance. Although it may sound like a lot, a few simple steps can shift your mindset and easily make saving a habit.

Here are eight things you can do right now to develop a saving mindset and build a better financial future.

1. Track your earnings and expenses

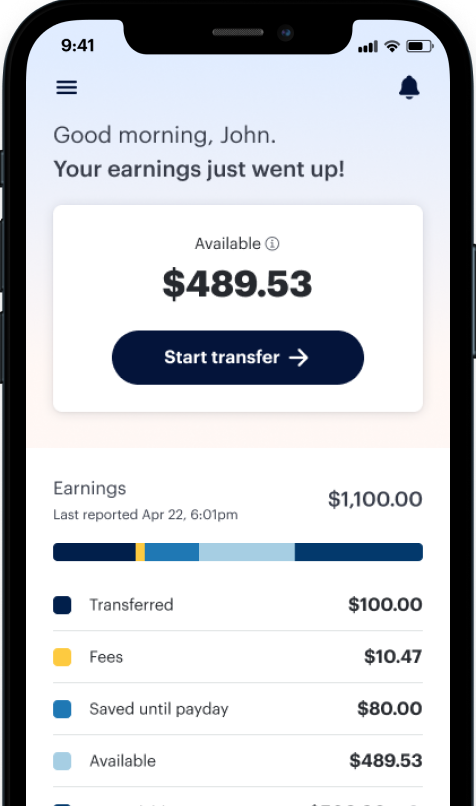

The first step to building an effective saving habit is to know how much money you earn and spend on a daily, weekly, monthly, and yearly basis. Go through your monthly bank account and credit card statements and list all your expenses. Use an app that allows you to track your earnings spending in one place to make things easier.

2. Eliminate or reduce one recurring expense

With a list of all your expenses written down, find one to tackle. People who pay cell phone bills or cable bills may be eligible for a lower rate from their utility provider without even knowing. It’s up to you to follow up with your service providers to ensure you’re getting the best rate possible.

They won’t reach out to you. Digital subscriptions are always good places to look when wanting to eliminate a recurring expense. Consolidating credit cards or loan payments can help reduce an expense.

3. Start a digital savings jar

Most people are familiar with the concept of throwing extra coins into a jar to save some cash for a rainy day. But with more purchases taking place digitally, physical savings jars are becoming a thing of the past.

Consider using many of the DailyPay financial tools available for managing your spending and saving. Set aside funds to reach your savings goals and make saving a habit.

- Set a specific, achievable goal

The key to efficient savings is consistency. If you set a goal too lofty or unviable, it will be very easy to call it quits as soon as a setback occurs.

Make sure your goal is very specific so it’s possible to track. Instead of saving for a vacation, try saving $1,000 in 10 months for a flight to Hawaii.

That’s $100 a month or $25 a week or $3.28 a day – be specific. Then ensure that the amount you set aside regularly isn’t cutting into the money needed to handle your essential expenses.

5. Automate your savings

The most efficient way to set aside money for savings regularly is to automate your savings. All you have to do is decide on an amount you’d like to set aside from each paycheck, choose the account where you’d like to send it, and then forget it. This way, you don’t have to remember to set aside savings each week, so you don’t have to worry about missing your goal.

6. Implement a waiting rule for all non-essential purchases

With one-click purchases and two-day delivery being the norm these days, impulse buying is easy. A waiting rule means that you have to wait a certain amount of time before making a non-essential purchase.

This will give you a cooling-off period to evaluate whether the purchase is truly within your budget and helps avoid impulsive spending. Time can be whatever works for you. The 48-hour rule and the 30-day rule are two popular methods that could work.

7. Share your goals with a trusted person

Simply verbalizing your goals to yourself can help keep you on track. But to take it a step further, research has shown that sharing your goals with a trusted person can help keep you on track.

Making a public commitment to a goal increases the likelihood of following through because we strive to maintain consistency between our words and actions to preserve our self-image and social standing.

8. Track your progress

Even if you set up an automated savings system where you can forget about it each week and not think about hitting your goal, you should still regularly track your progress.

Make sure to keep note of weeks where it was harder than you thought it would be and weeks where you had more money to save than you anticipated. This will help you optimize your savings habit in the future, and ultimately, having a saving mindset means adapting your saving contributions regularly to adapt to life’s changes.

To develop a saving strategy and save like a pro, you have to shift your mindset from traditional budgeting to saving for the future.

Say goodbye to the short-term “earn and spend” way of thinking and embrace a long-term approach that challenges instant gratification.

A saving mindset is a holistic approach to personal finance that goes beyond simply setting money aside. It’s a psychological framework that shapes how you think and interact with money.

Check out DailyPay to learn how it can help you easily create a realistic saving strategy so you can build a better financial future.

The DailyPay Visa® Prepaid Card is issued by The Bancorp Bank, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. and can be used everywhere Visa debit cards are accepted.

Your funds are FDIC insured through The Bancorp Bank, N.A.; Member FDIC. DailyPay is not FDIC-insured. Deposit insurance coverage only protects against failure of The Bancorp Bank, N.A.

All information herein is for educational purposes only and should not be relied upon for any other use. The information herein does not constitute the rendering of financial, business, accounting, securities, tax or legal advice or other professional advice by DailyPay. No fiduciary obligation or duty exists, or is created, between you and DailyPay. DailyPay does not warrant the completeness or accuracy of any information provided to you.