There’s something to be said about leaving work behind and taking a much-needed getaway. Spring break is right around the corner, which means now is the ideal time to start prepping your budget. The average cost for one person to take a weeklong vacation in the U.S. is about $1,559, according to Budget Your Trip.

With the right planning, you might find ways to bring that number way down. Here are 10 tips for saving on spring break travel this year.

1. Opt for a road trip.

Airfare could represent your biggest travel expense. Research some destinations that are within driving distance, then see if you can spin one into a fun spring break trip. If you can split gas with a friend, all the better. Campsites can be particularly cost effective. For a more unique experience, you can also think about splitting a tiny house with a friend or significant other. Most are super minimal and designed to help guests connect with nature and outdoor activities.

2. Travel on off days.

Check your calendar to see if there’s any flexibility in your travel schedule. Taking a trip when local schools and universities are on spring break could leave you stuck with limited accommodations and higher prices. You’re also more likely to deal with crowds. Instead, booking a vacation during the week—or before or after peak times—might help you find better deals. If you’ve got a stockpile of paid time off, now might be the time to use it!

3. Take advantage of group rates.

Many cruise lines offer discounted rates for large parties. Royal Caribbean, for example, doles out a free cruise credit if you have at least 16 people in your party and book eight staterooms or more. You can use this credit to reduce multiple fares in your group. Rallying friends and family to tag along on your next trip could also open up cheaper hotel packages. In some cases, splitting the cost of a large Airbnb might be more affordable than getting individual hotel rooms.

4. Work with a travel agent.

Partnering with a travel agent has its perks. For one, they’ll be able to create a trip that’s tailored to you. You might also snag some savings. One study found that the average consumer who worked with an agent saved over $450 per trip. As for their fee, some of it might be covered by hotels and other wholesalers in the travel space. Another benefit is that an experienced travel agent will likely have insider knowledge when it comes to fun things to do on your trip.

5. Put your tax refund toward your trip.

Tax refunds can feel like a nice wave of found money. For the 2020 tax year, the average refund came in at $2,800, according to IRS data. Money like that could cover your entire vacation. Those who are expecting a refund might want to file their tax return electronically and opt for direct deposit—the IRS says that’s the fastest way to get your cash. Filing sooner rather than later can also speed things up. 2022 tax returns are due on April 18, 2023.

6. Visit a budget-friendly destination.

Some destinations are simply more expensive than others. When it comes to budget-friendly locales, U.S. News & World Report calls out New Orleans, South Padre Island, and Panama City as being particularly wallet-friendly. They considered everything from lodging to atmosphere to free things to do. Key West and the Grand Canyon also made the top 10.

7. Pick up a side hustle.

Forty-five percent of working Americans have a side gig, according to a recent Side Hustle Nation poll. It can be a great way to generate some extra money to put toward your travel fund. If you already have a side business, see if you can dial up your efforts before taking off this spring break. Those who are new to the game can explore gigs like driving for Grubhub, shopping for Instacart, mowing lawns, or tutoring online. The idea is to find something you don’t mind doing, then go hard without affecting your 9-to-5 job.

8. Look for deals on flights.

The more flexible you are with your travel plans, the more likely you’ll be to find good deals. Consider flying during off-peak times if necessary. Experian reports that Tuesday, Wednesday and Saturday are usually the cheapest days to fly. (Friday and Sunday typically cost the most.) Comparing fares on travel sites like Kayak and Google Flights can come in handy too. If you’re able to rent out your home on Airbnb while you’re away, you might even recoup some of the money you spend on flights.

9. Use credit card rewards.

Credit card rewards can unlock significant savings, especially if you have a card that earns miles or hotel stays. Cash back credit cards are also useful because you can use that money to pad your travel fund. No matter what you choose, be mindful of paying your bill in full each month. Carrying a balance could trigger heavy interest fees, which negate the whole benefit of earning points.

10. Start saving early.

With spring break so soon, getting your finances ready for a trip might feel like a tall order. If that’s the case, consider a low-key staycation this year—then begin saving now for next year. Putting just a little bit aside each month can add up. If you squirrel away $50 per paycheck, you could have $1,200 in a year’s time. Set a monthly savings target that works for you and go from there. For a boost of motivation, add a line item on your budget that says “travel fund.” It’ll remind you why you’re saving.

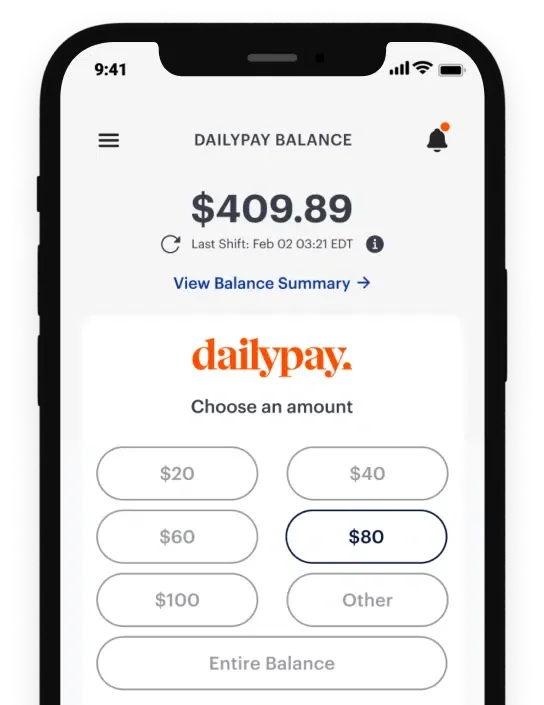

Whether you’re saving for a trip or building your emergency fund, DailyPay allows you to access your earned pay whenever you need it. We’re here to help bring you a little closer to your next financial goal.