The upside is that there are some simple ways to stretch your paychecks a little further without having to live like a cheapskate. Check out these 10 easy hacks to help you save on everyday spending.

1. Make a spending plan.

The first (and probably most important) action item is revising your budget. No need to stress if you don’t already have a household spending plan. Implementing a simple monthly budget is fairly straightforward. It begins with identifying two key financial details — your income and your spending. In other words, how much money comes into and out of your household every month? The more clarity you have here, the more accurate your budget will be. If you’re currently spending more than you make, you’ll have to either reduce your expenses or increase your income to avoid accumulating debt.

2. Cut unnecessary bills.

This is the natural next step after tip #1. When you’re looking at your expenses in black and white, you may notice a few things that can be eliminated right off the bat. Unused subscription services are a great example, especially if you forgot to cancel a free trial period and are now being charged for something you don’t really need. Do yourself a favor and read through your bank statements from the past month or two. Are there any bills that seem unreasonably high?

Refinancing student loans is one way to lower your monthly payment and reduce your interest rate at the same time. Many energy providers also offer some form of “budget billing” where you pay a fixed monthly rate that’s based on your average annual energy usage. This is all to say that there are creative ways to bring down your regular monthly bills.

3. Start meal planning.

The average consumer spends $2,375 per year on restaurants and take-out orders, according to the BLS data mentioned earlier. Fortunately, there are ways to save. Eliminating it altogether isn’t very realistic — you have to live, after all — but meal planning can have a big impact. Carve out a little time each weekend to prep for the week ahead. Leaning on ingredients you already have can help make your meals a little cheaper. When you have a plan, you’ll also be less likely to Grubhub dinner or hit a drive-through.

4. Make coffee at home.

$2 here and $4 there doesn’t seem like much, but your daily cup of Joe can add up. One survey from the popular investing app Acorns found that the average American drops roughly $1,100 per year on coffee. What’s more, 34% spent more on coffee than they invested in their retirement accounts. Embracing home brew could be an effective way to bring down your total spend.

5. Opt for at-home get-togethers.

Happy hours and bar meetups can put a dent in your budget. Check in with your friend group to see if anyone’s down for at-home get-togethers instead (while adhering to CDC safety guidelines, of course). Maybe that translates to BYOB cocktails in the backyard or potluck dinners or brunches on the patio. The idea is to find cheaper ways to hang out that don’t create a regular bar tab or restaurant bill.

6. Use coupons.

This tip goes hand in hand with meal planning. When prepping your meals for the week, check in on weekly deals at your local supermarkets. You can use sale items and coupons to shape your dinner and lunch plans. You might be able to snag additional discounts by downloading store apps or subscribing to their email lists. Apps like Rakuten and Ibotta are other popular resources for coupons and cash back.

7. Buy discounted gift cards.

What stores do you shop at pretty regularly? One potential money-saving idea is to buy discounted gift cards, then use them at the checkout line. Sites like Raise and Gift Card Granny are known for offering pretty steep savings. At the time of this writing, Raise was selling Fandango gift cards for over 19% off — a simple way to save at the movies.

8. Consider subscriptions for essential items.

Think about the essential items you can’t avoid buying each month. Staples like toilet paper, paper towels and toiletries all fall under this umbrella. Depending on what you need, signing up for a subscription service could save you money each month. Amazon Family, for example, claims to offer up to 20% off on diapers, baby food and other childcare essentials. It’s also convenient in that you don’t have to go out and buy these items month after month.

9. Split streaming services with friends or family.

You may be paying for certain streaming services you don’t really use, in which case you could cut them entirely and say goodbye to the bill. But some creature comforts just make life a little better. Instead of eliminating them, see if you can split any subscriptions with friends or family. This can include everything from Hulu and Netflix to HBO Go and Amazon Prime. Maybe you can cover one bill and someone else can cover another (then you share your logins). Note: Check the provider’s terms of service on their split cost policy.

10. Get a cash back credit card.

There’s some spending we simply can’t avoid, so why not get paid for it? Cash back credit cards allow you to earn cash rewards for everyday spending. Your best is using it for essential spending only, then paying it off in full each month so that you aren’t hit with interest charges. From there, you’ll accumulate points as you go. Cash back rewards can generally be transferred directly into your checking account, effectively reducing your monthly spending in the process.

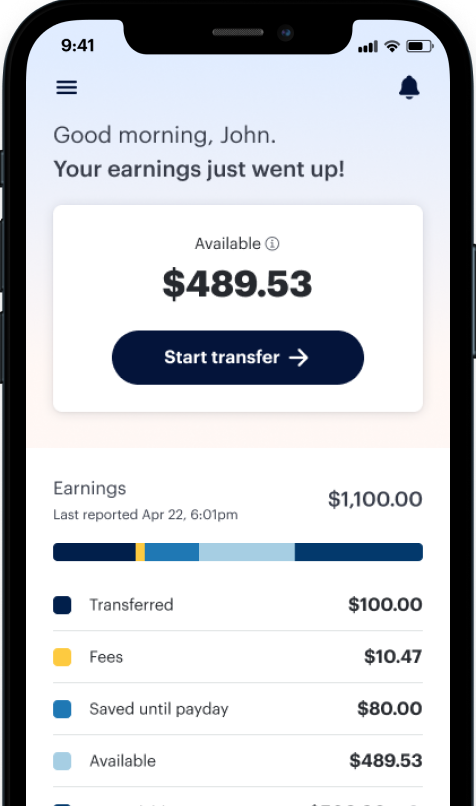

Having on-demand access to your earned pay can help you cover your bills on time without incurring late fees. It can also help you avoid credit card debt. DailyPay lets you tap your earnings when you need them most.