Use your available earned wages as you need them, for no fee.2

Now you can decide how often you want to get paid and where your pay goes. The days of waiting for payday are over; work today and get paid whenever you want with these earned wage access1 (EWA) options.

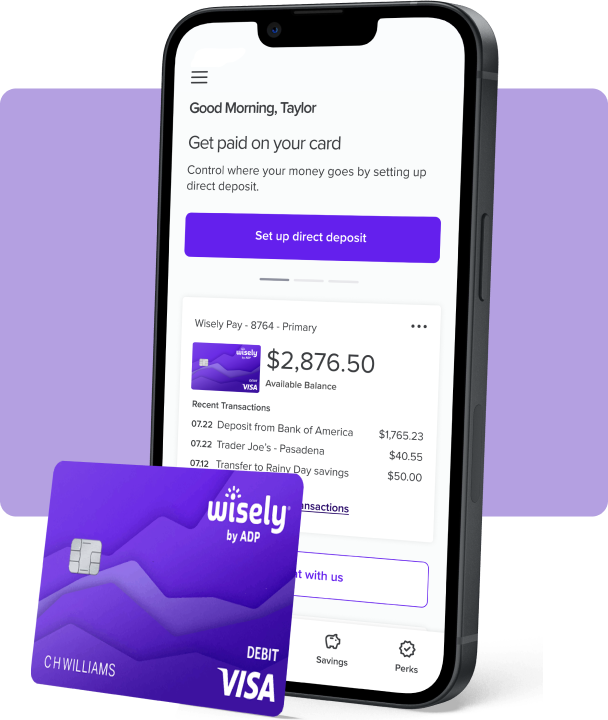

With Wisely®, you get a no-fee2 instant transfer each week along with access to all of Wisely’s financial wellness features — no bank details or credit check3 required!

When you enroll for Wisely, you get a debit card to spend your wages in-store and online & a mobile app4 to manage all the features that Wisely has to offer.

Early access to your available earned wages

Cashback Rewards5

Bill Pay6

Saving Tools7

Want a Wisely account?

Talk to your HR or payroll contact.

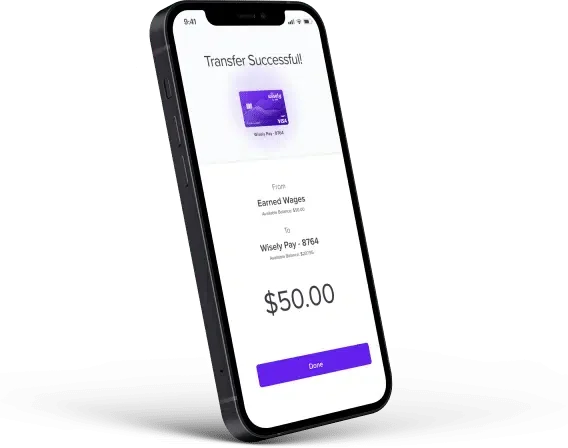

With this option, access your available earned pay multiple times each week, and transfer your funds to any account you want. Just sign up, add your bank account info, and you are ready to go.

Early access to your available earned wages

Additional transfers

Use an account of your choice

Earned Wage Access1, or EWA, is the ability for you to access a portion of your already earned wages, if needed, outside of a traditional pay cycle. It’s also sometimes referred to as early pay, instant pay or on-demand pay.

Being able to access your available earned wages before your designated payday can benefit your financial well-being and build financial stability and savings.

You can now access a portion of your pay when you need it rather than waiting for payday.

First, you have to choose how often you want access to your pay. For no fee,2 you can transfer once a week in addition to payday through Wisely, or as often as you want for a small fee through DailyPay.1

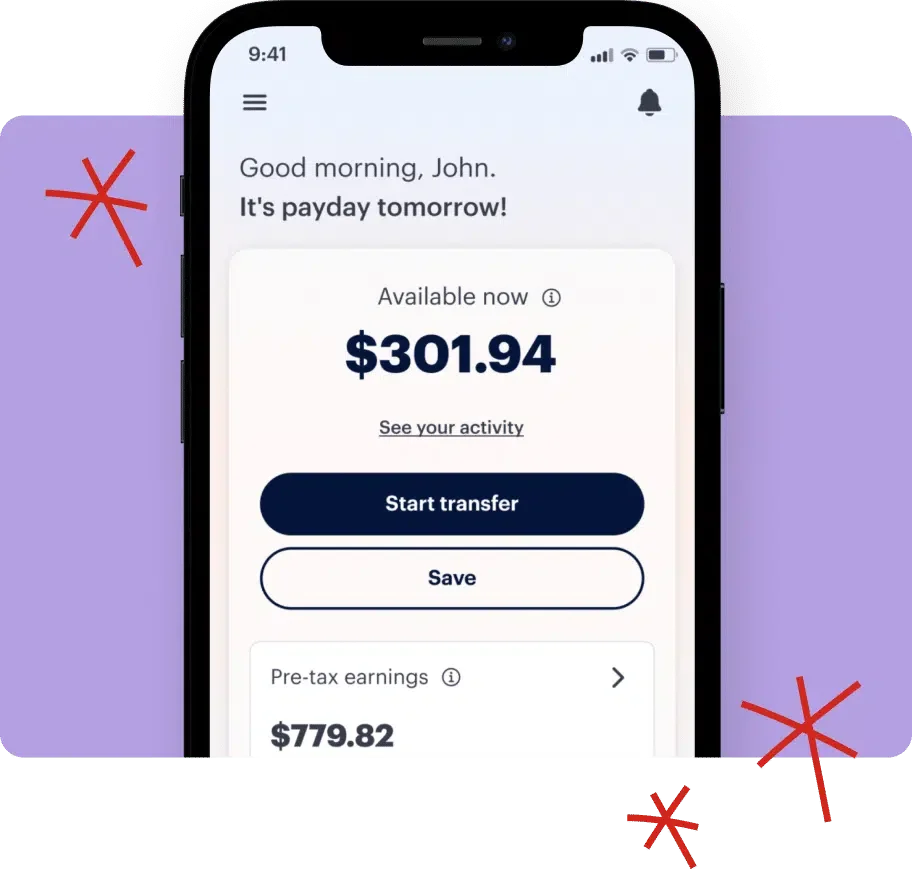

After registering for one of the above options, you can easily request your available earned wages right from either the myWisely® mobile app4 or from the DailyPay app. The available balance at any given time is calculated based on your regular compensation and hours, accounting for withholdings, worked to date during the pay period.

Wisely® members can make one no-fee weekly transfer to your Wisely account right in the myWisely app4 (“Wisely EWA”).

With DailyPay, you can make daily transfers to any bank account, debit card, or prepaid card (including the Wisely card), for a small fee.

Both options are offered through your employer so that you can have the benefit of choice. Wisely EWA offers no-fee2 transfers once per week to your Wisely account. To use this option, you must have your entire net pay deposited onto your Wisely card, including the EWA transfer.

DailyPay offers daily transfers to any account (i.e. bank account, debit card, prepaid card) for a small fee.

If you are already a Wisely member, you can enable Wisely EWA within the myWisely app4.

You can sign up for DailyPay EWA by downloading the DailyPay app, accessible in the Apple® App store or Google Play™ Store, or by visiting dailypay.com.

You do not need a traditional bank account to sign up for Wisely EWA; you only need a Wisely account and access to myWisely. You do need a bank account, debit card or prepaid card to sign up for DailyPay.

Yes, you can transfer funds from your DailyPay account to a Wisely account, as long as your account has been upgraded8

Employees are eligible to opt into EWA. However, EWA is only available to residents in the US. Additionally, salaried employees earning a base salary of more than $200,000 or hourly employees earning more than $100 per hour are not eligible for EWA.

Yes! You can switch to Wisely EWA as long as you do not have a negative balance. Once you have met the requirements, you will begin seeing your pay balance in myWisely and you can complete the Wisely EWA opt-in process there.

Yes! You can switch to DailyPay EWA, but you must complete the Wisely EWA cancellation process, which requires a $0 outstanding balance and the completion of a pay cycle. In order to initiate the cancellation process, you must opt-out of EWA by going to the myWisely Account Settings, click on Earned Wage Access, and toggle the switch from on to off.

To cancel, you follow the opt-out steps described above. In order to initiate the cancellation process, the Wisely EWA user must opt-out of EWA by going to the myWisely Account Settings, click on Earned Wage Access, and toggle the switch from on to off. Canceling an account requires a $0 outstanding balance and the completion of a pay cycle, as well.

To cancel a DailyPay account, you log in to dailypay.com, click the person icon in the top right corner, and go to your Account Settings. Then scroll to the bottom of the page and click “Want to opt out of DailyPay? Click here to cancel your account.”

Wisely Member support is available via phone (1-866-313-6901) and live chat in the myWisely app4. Both are available 24/7, in both English and Spanish.

DailyPay Support is available via phone (1-866-432-0472), email (employee.support@dailypay.com), and live chat in the DailyPay app. These options are available 24/7, in both English and Spanish.

1 Earned Wage Access powered by DailyPay, is available to Wisely Pay cardholders through the myWisely app or at mywisely.com once your Wisely card is activated. Earned Wage Access is also available directly through the DailyPay app or at www.dailypay.com. Additional terms and limits apply. Opt-in is required. This optional offer is not a Fifth Third Bank, Pathward, Mastercard or Visa product or service, nor does Fifth Third Bank, Pathward, Mastercard or Visa endorse this offer.

2 While this feature is available without a fee, certain other transaction fees and costs, terms, and conditions are associated with the use of this card. Please log in to the myWisely app or mywisely.com to see your cardholder agreement and list of all fees for more information.

3 The Wisely card is a prepaid card. The Wisely card is not a credit card and does not build credit.

4 Standard message and data rates may apply.

5 Cash back rewards on purchases at participating merchants are powered by Dosh Rewards. Opt-In is required for Dosh Rewards only. Most Cash Back Rewards will appear in your Wisely Rewards savings envelope within 4 weeks after the transaction has completed. Only Cash Back Rewards for the purchase of eGift cards will appear instantly. eGift Card Cash Back offers range from 2% – 12%, depending on the gift card that is purchased. Cash Back amounts will be disclosed before you select a gift card. Please review the Terms and Conditions of each eGift card product before purchase. Funds from all Rewards can be moved from the savings envelope into the available balance on your card. You must log in to myWisely to access the Rewards features for purchases and eGift cards. These optional offers are not Fifth Third Bank, Pathward, Mastercard, or Visa products or services, nor does Fifth Third Bank, Pathward, Mastercard, or Visa endorse these offers.

6 The bill pay feature, powered by Papaya, is available through the myWisely app. Additional terms and limits apply. This optional offer is not a Fifth Third Bank, Pathward, Mastercard, or Visa products or services, nor does Fifth Third Bank, Pathward, Mastercard, or Visa endorse these offers.

7 Amounts transferred to your savings envelope will no longer appear in your available balance. You can transfer money from your savings envelope back to your available balance at any time using the myWisely app or at mywisely.com.

8 If you have a Wisely Pay card (see back of your card), access to certain features or loading funds from sources other than the company you received your card through requires an upgrade, which you can request in the myWisely app. Requesting an upgrade will automatically initiate an identity verification process utilizing your personal information already on file which must be validated in order to upgrade. Card may be restricted or closed if your identity cannot be verified. Upgrade may not be available to all cardholders.

The Wisely Pay Visa® is issued by Fifth Third Bank, N.A., Member FDIC or Pathward®, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. The Wisely Pay Mastercard® is issued by Fifth Third Bank, N.A., Member FDIC or Pathward, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. The Wisely Direct Mastercard is issued by Fifth Third Bank, N.A., Member FDIC. ADP is a registered ISO of Fifth Third Bank, N.A., or Pathward, N.A. The Wisely Pay Visa card can be used everywhere Visa debit cards are accepted. Visa and the Visa logo are registered trademarks of Visa International Service Association. The Wisely Pay Mastercard and Wisely Direct Mastercard can be used where Debit Mastercard is accepted. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. Apple Pay is a registered trademark of Apple Inc. Google Pay is a trademark of Google LLC. ADP, Wisely, myWisely, and the Wisely logo are registered trademarks of ADP, Inc. Copyright © 2024 ADP, Inc. All rights reserved.