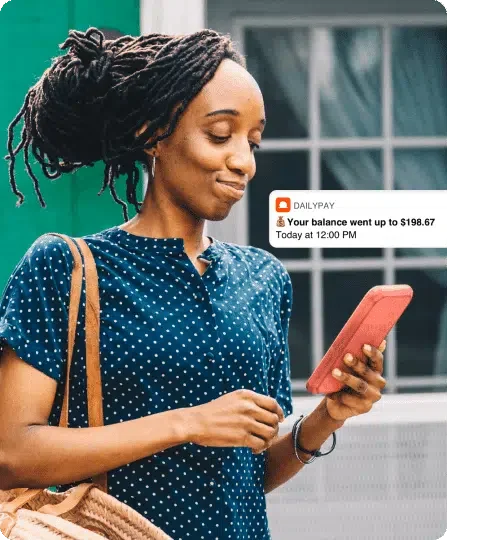

DailyPay is an optional service that allows you to get your pay any time before payday and easily track how much you’re making.

Get DailyPay

No cost to create an account. Set up takes 2 minutes.

Get your pay

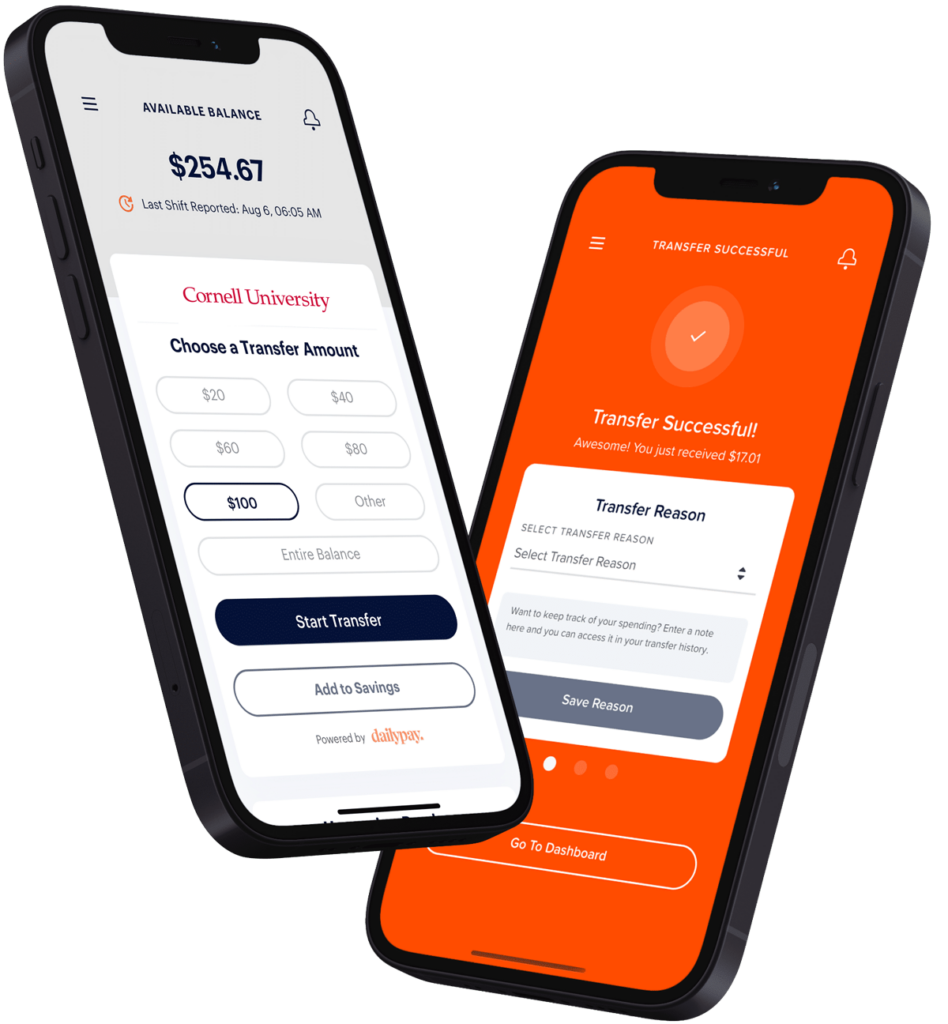

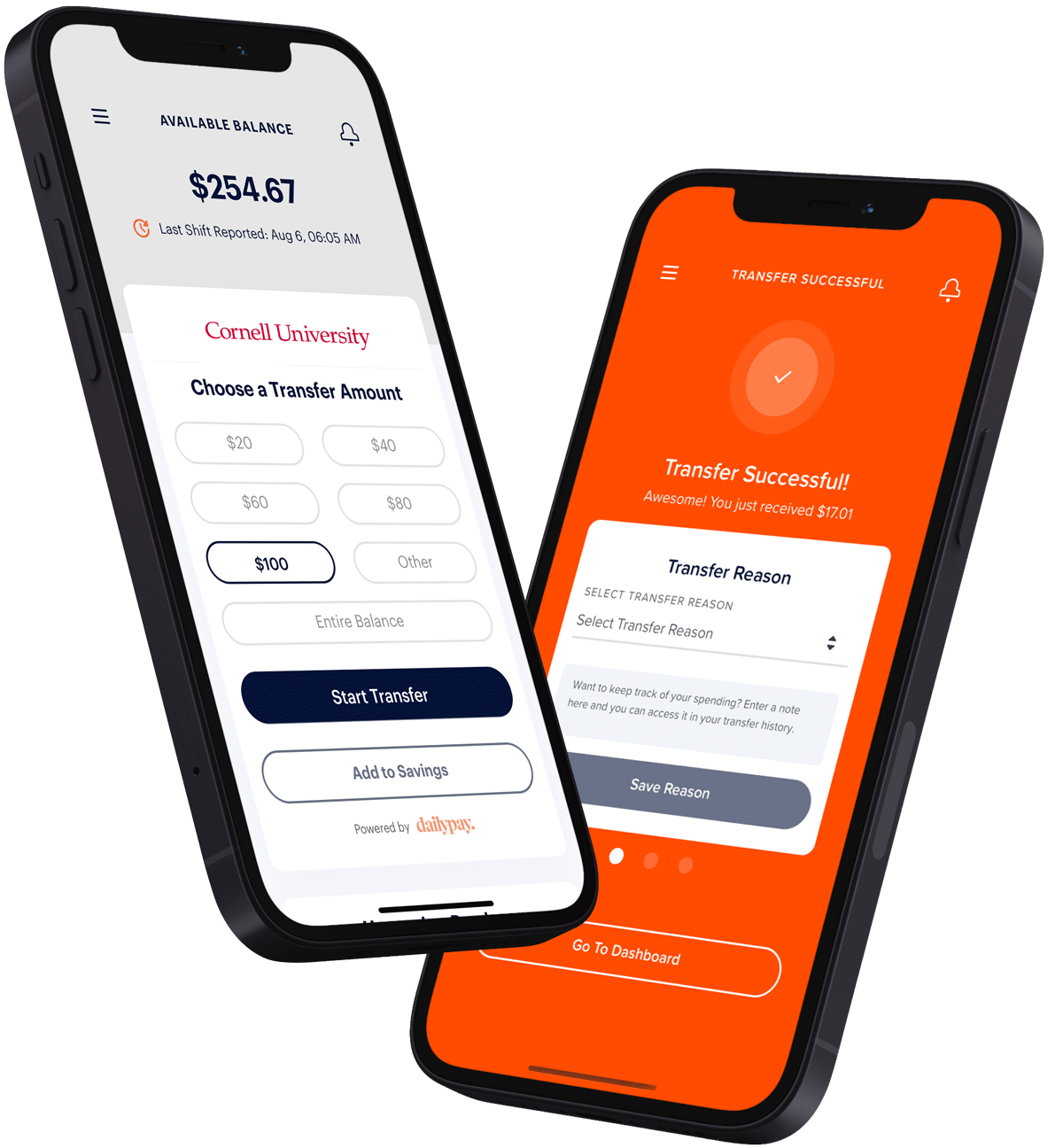

Transfer your earned Cornell University pay to your debit card or bank account any time before payday.

Get the rest on payday

Whatever you don’t transfer is sent to you at no cost on your payday.

Need your earned pay right now? Transfer available funds to your debit card at any time before payday.

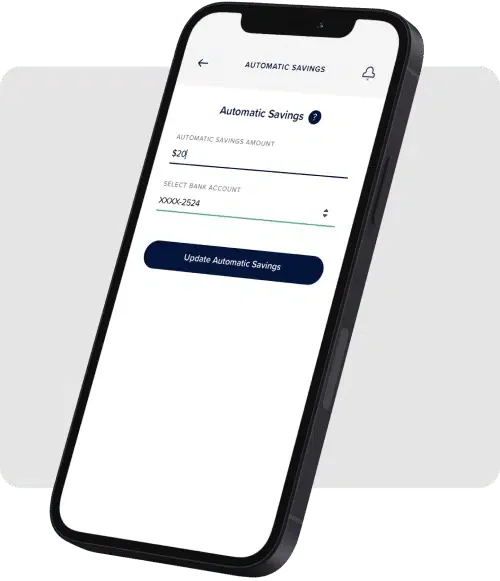

Automatically deposit money from each Cornell paycheck to your own savings account with your available earned wages.

Your available pay increases each time you work so you can easily track how much you’re making.

“It helps me from being late on bills or being late on rent. It's a lifesaver. DailyPay is right there to catch you when you're falling.”

“DailyPay made me feel great because of the savings account. A certain amount of my pay goes to my savings account which helps me save money.”

“Because of DailyPay I was able to get my money right then and there. It is a blessing being able to get your money without having to turn to cash advances and pay excessive fees.”

*DailyPay compensated reviewers for feedback

When you sign up for DailyPay through Cornell University, you’ll be able to access your earned pay, 24/7/365. DailyPay enables you to view your Cornell University paycheck and transfer the money to a bank account, pay card, or debit card for a transactional fee. You can also save your earned pay in a savings account of your choice at no cost.

DailyPay is not a payday loan. Payday loans often have hidden fees or interest payments that can leave the borrower in debt. DailyPay enables you to access your earnings before payday, and there is no loan to repay of any kind.

No, this is not a loan. We are here to stop you from needing to take out a loan. By using DailyPay, you are simply transferring your own earned income into your bank account or card. You can only transfer money that you have already earned, but that has not yet been paid to you.

Each day you work, you build up a Pay Balance in your DailyPay account that can be transferred into your bank account, to your debit card or to your payroll card. This balance is updated when you clock out of each shift. You can access funds from your Pay Balance instantly or next-business day. Whatever money is leftover in your Pay Balance, after you make transfers during a pay period, will automatically be paid to you on your next payday as Remainder Pay. Our software uses an algorithm that prevents you from taking out more money than you have. The Pay Balance you see in your DailyPay account is your net Pay Balance and excludes any estimated taxes, deductions, and other withholdings such as garnishments. You can use the DailyPay app, a tablet, or a computer to access your earned and unpaid income.

DailyPay can provide you with many benefits. They include, but are not limited to:

Once you make a transfer, your direct deposit in Workday will be changed to an account DailyPay will establish for your participation in the program. On payday, DailyPay will send your Remainder Pay to the primary bank account you specify in your DailyPay account settings. Since DailyPay becomes your account and routing number on file in Workday, any updates or changes to your direct deposit information must be done within your DailyPay account or there could be a delay in your pay.

By following the steps below, you may cancel your account. If you have made an earnings transfer ahead of payday, you may request DailyPay account closure at any time, but we’ll receive one final paycheck from your employer to cover the transfers that we sent you early, passing along any remaining pay to your bank account on file.

Once we receive this final paycheck and the account balance is covered, your account will be fully canceled out. This process can take up to a couple pay periods to ensure full account closure. Your account number on file will be automatically sent back to your employer as the deposit account on record. You do not need to update your HR system.

App and Website:

DailyPay offers a variety of pricing options for early access to your earned pay, ranging from no-fee to fee-based options. Check with your employer or contact DailyPay customer services click here to learn more about the options available to you.

If you have a specific question about DailyPay or your account that is not answered here, there is a help section within your DailyPay account where you may be able to find the answer to your question.

If you still need help, contact our customer support team.

Available 24 hours a day, 7 days a week*.

Closed on select U.S. Holidays.

Click here to get help.

*24/7 customer support is not applicable to all DailyPay partners.