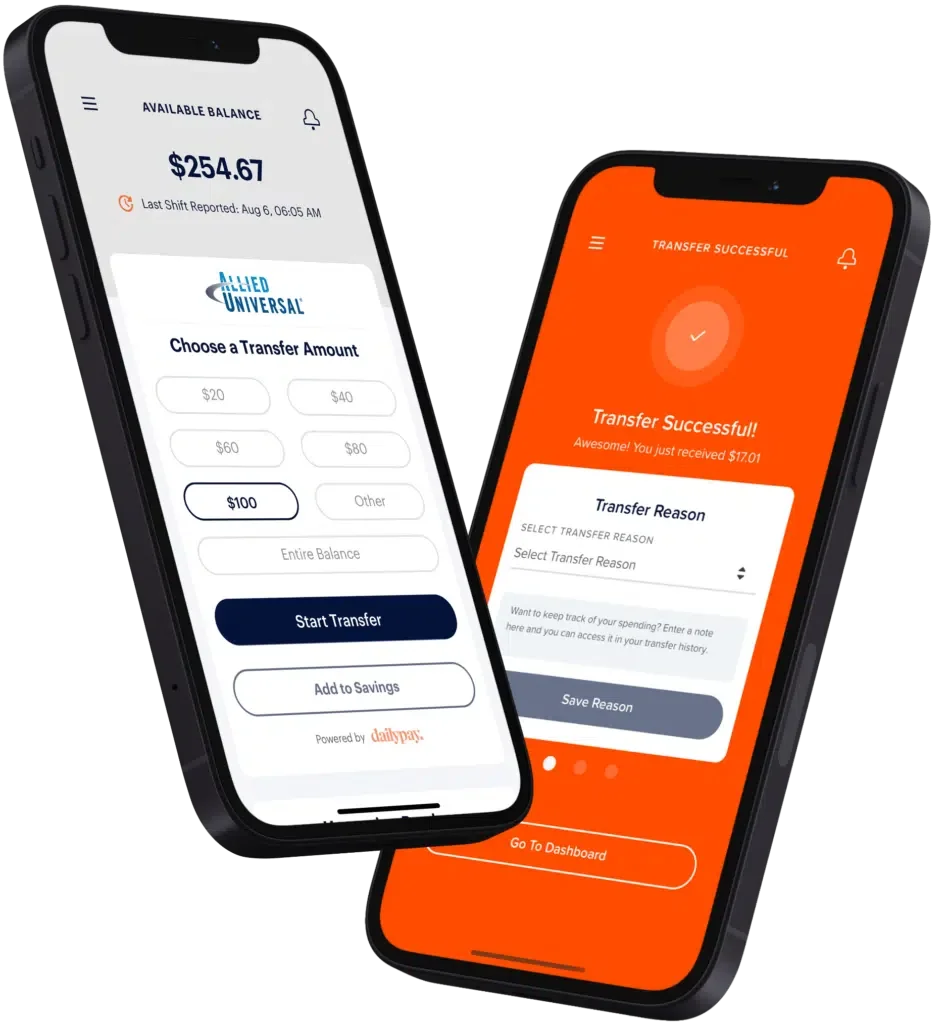

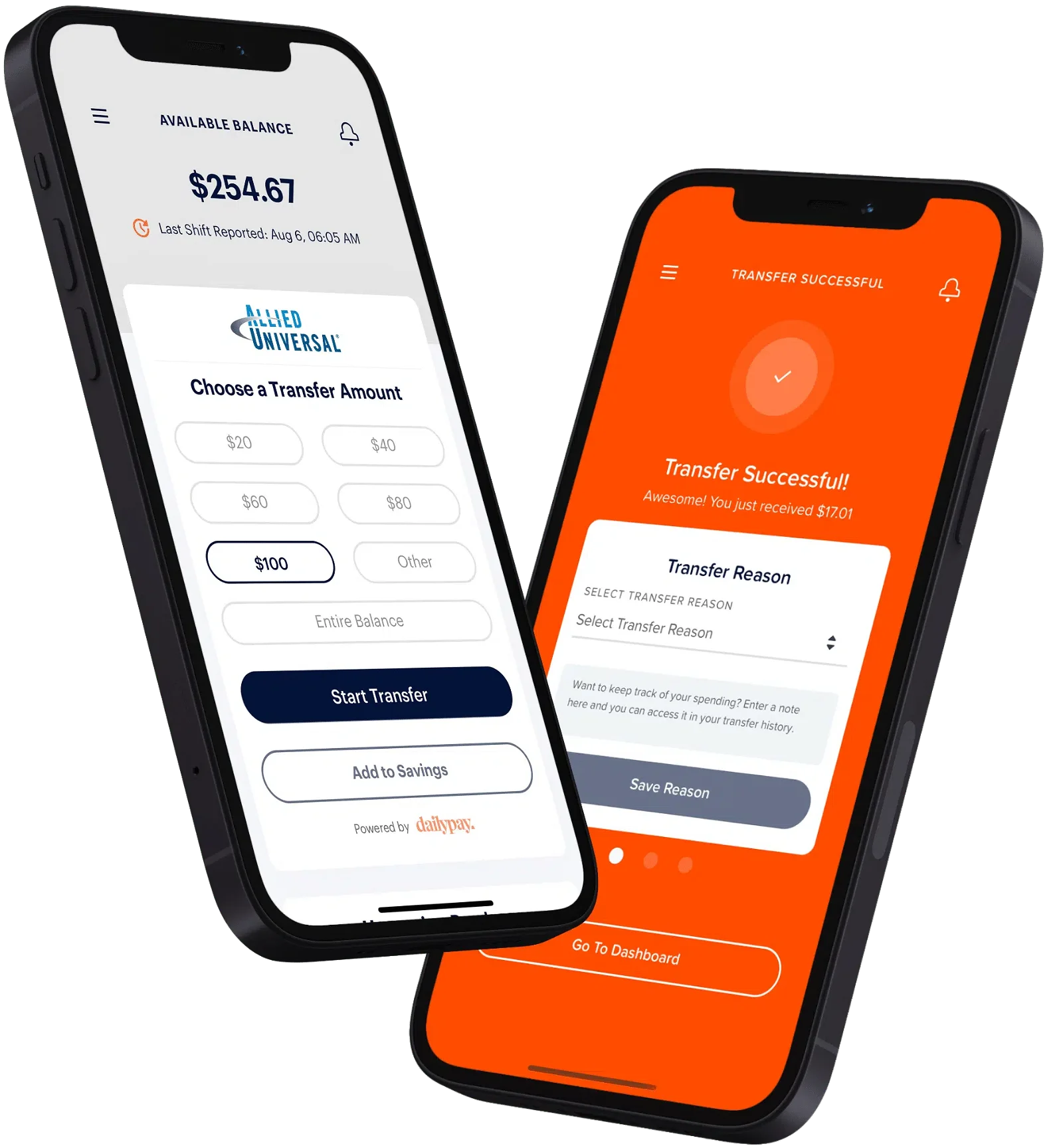

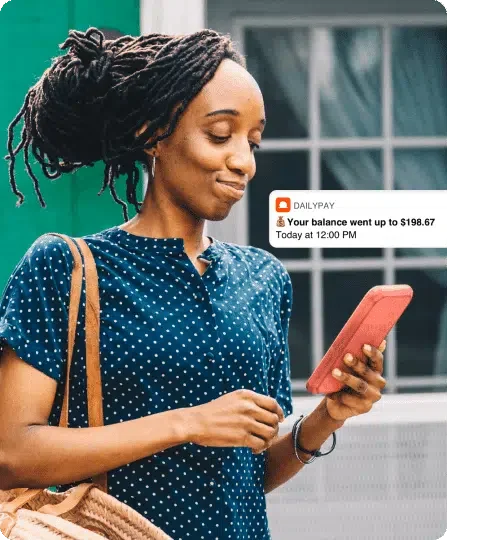

DailyPay and Allied Universal® teamed up so you can get your earned pay any time before payday.

Get DailyPay

No cost to create an account. Set up takes 2 minutes.

Get your pay

Transfer your earned Allied Universal® pay to your debit card or bank account any time before payday.

Get the rest on payday

Whatever you don’t transfer is sent to you at no cost on your payday.

Need Allied Universal® money right now? Transfer your earned pay instantly to your debit card at any time before payday.

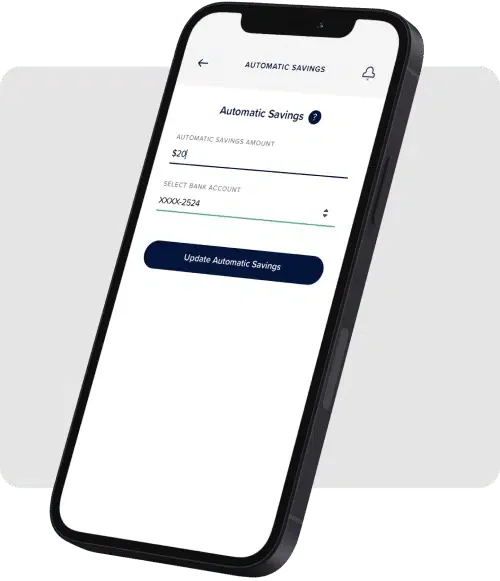

Automatically deposit money from each Allied Universal® paycheck to your own savings account with Auto Save.

Your available pay increases each time you work so you can easily track how much you’re making.

FRIDAY BY DAILYPAY

Friday by DailyPay is a general purpose reloadable (GPR) card and app that allows you to make instant transfers of your earned pay for no fee.1

1 Requires employer participation in DailyPay and election to deposit early transfers and set direct deposit to the Friday Card.

The Friday by DailyPay™ Visa® Prepaid Card is issued by The Bancorp Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. and can be used everywhere Visa debit cards are accepted.

“It helps me from being late on bills or being late on rent. It's a lifesaver. DailyPay is right there to catch you when you're falling.”

“DailyPay made me feel great because of the savings account. A certain amount of my pay goes to my savings account which helps me save money.”

“Because of DailyPay I was able to get my money right then and there. It is a blessing being able to get your money without having to turn to cash advances and pay excessive fees.”

*DailyPay compensated reviewers for feedback

When you sign up for DailyPay through Allied Universal®, you’ll be able to access your earned pay, 24/7/365. DailyPay enables you to view your Allied Universal® paycheck and transfer the money to a bank account, pay card, or debit card for a transactional fee. You can also save your earned pay in a savings account of your choice at no cost.

Break free from predatory loans, late fees, and overdraft charges. With DailyPay, access your money when you need it—no required fees, no hidden conditions.

Each day you work, you build up a Pay Balance in your DailyPay account that can be transferred into your bank account, to your debit card or to your payroll card. This balance is updated when you clock out of each shift. You can access funds from your Pay Balance instantly or next-business day. Whatever money is leftover in your Pay Balance, after you make transfers during a pay period, will automatically be paid to you on your next payday as Remainder Pay. Our software uses an algorithm that prevents you from taking out more money than you have. The Pay Balance you see in your DailyPay account is your net Pay Balance and excludes any estimated taxes, deductions, and other withholdings such as garnishments. You can use the DailyPay app, a tablet, or a computer to access your earned and unpaid income.

DailyPay can provide you with many benefits. They include, but are not limited to:

DailyPay offers a variety of pricing options for early access to your earned pay, ranging from no-fee to fee-based options. Check with your employer or contact DailyPay customer services click here to learn more about the options available to you.

If you have a specific question about DailyPay or your account that is not answered here, there is a help section within your DailyPay account where you may be able to find the answer to your question.

If you still need help, contact our customer support team.

Available 24 hours a day, 7 days a week*.

Closed on select U.S. Holidays.

Click here to get help.

*24/7 customer support is not applicable to all DailyPay partners.